The Facts About Amur Capital Management Corporation Revealed

A business's capability to raise dividends constantly can show protability. Companies that have excess money ow and solid nancial positions usually choose to pay dividends to attract and compensate their shareholders.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

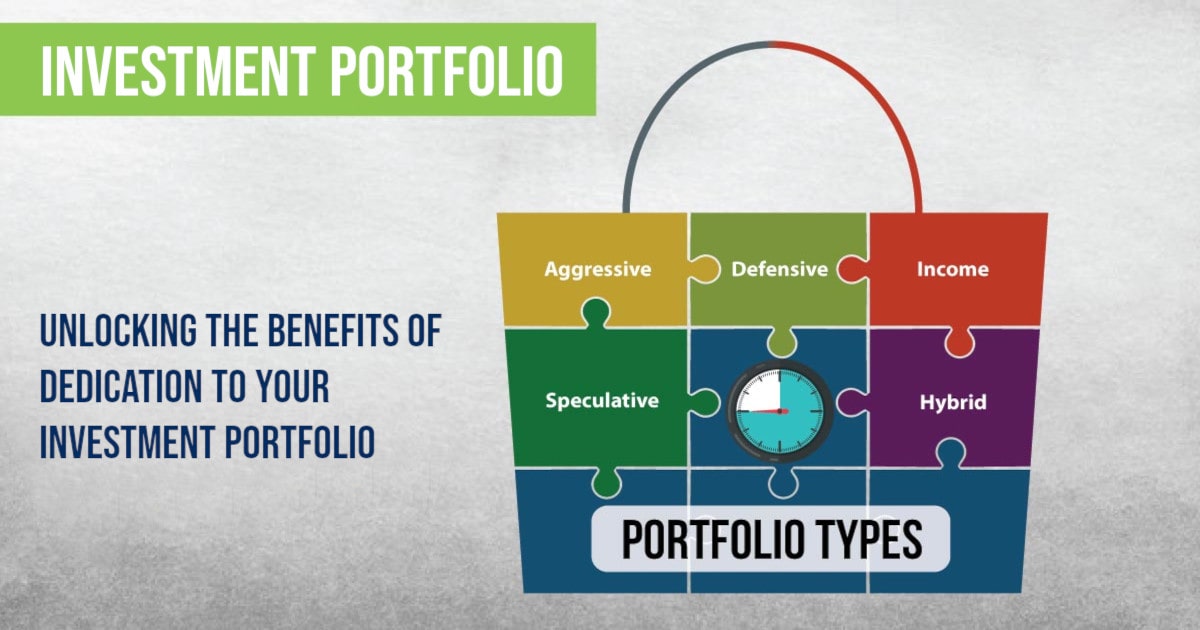

Diversifying your financial investment portfolio can help protect versus market uctuation. Look at the dimension of a firm (or its market capitalization) and its geographical market United state, established worldwide or emerging market.

In spite of exactly how easy digital investment administration systems have actually made investing, it shouldn't be something you do on a whim. In fact, if you determine to enter the investing globe, something to think about is the length of time you really wish to spend for, and whether you're prepared to be in it for the long run.

There's a phrase common connected with investing which goes something along the lines of: 'the ball might go down, yet you'll desire to make certain you're there for the bounce'. Market volatility, when financial markets are going up and down, is a typical phenomenon, and lasting can be something to assist smooth out market bumps.

Amur Capital Management Corporation for Beginners

Keeping that in mind, having a long-lasting approach might aid you to take advantage of the marvels of compound returns. Joe invests 10,000 and gains 5% returns on this financial investment. In year one, Joe makes 500, which is paid back into his fund. In year two, Joe makes a return of 525, because not just has he made a return on his preliminary 10,000, however also on the 500 invested reward he has made in the previous year.

Rumored Buzz on Amur Capital Management Corporation

One means you could do this is by obtaining a Supplies and Shares ISA. With a Stocks and Shares ISA. passive income, you can invest approximately 20,000 each year in 2024/25 (though this is subject to change in future years), and you don't pay tax on any returns you make

Starting with an ISA is actually very easy. With robo-investing platforms, like Wealthify, the effort is provided for you and all you require to do is pick exactly how much to invest and choose the danger degree that fits you. It might be one of minority circumstances in life where a much less emotional technique can be advantageous, however when it involves your finances, you might desire to listen to you head and not your heart.

Remaining concentrated on your long-lasting objectives could help you to prevent illogical choices based on your emotions at the time of a market dip. The data don't lie, and long-lasting investing could include several benefits. With a made up approach and a lasting investment technique, you could potentially expand even the smallest quantity of cost savings into a decent amount of money. The tax obligation treatment depends upon your individual scenarios and may go through alter in the future.

Amur Capital Management Corporation - The Facts

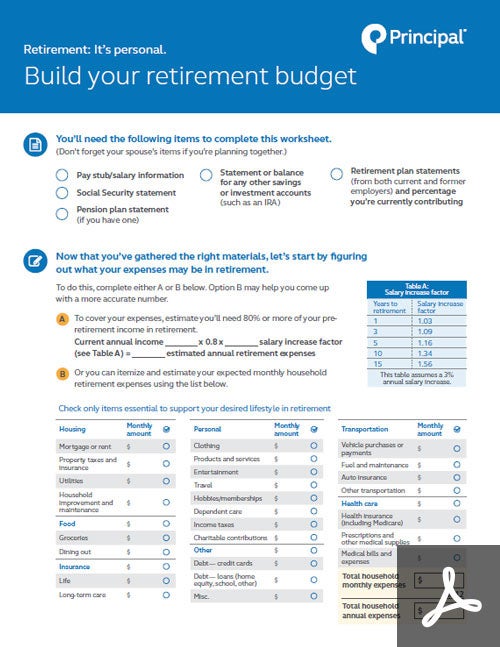

Investing goes one step even more, aiding you achieve individual objectives with three significant advantages. While saving ways alloting part of today's cash for tomorrow, spending ways putting your cash to work to possibly make a better return over the longer term - investing for beginners in canada. https://www.webtoolhub.com/profile.aspx?user=42387048. Different courses of financial investment assets cash money, dealt with interest, building and shares typically create different degrees of return (which is family member to the risk of the investment)

As you can see 'Development' properties, such as shares and property, have traditionally had the most effective general returns of all property classes but have actually additionally had larger tops and troughs. As a capitalist, there is the possible to earn capital development over the longer term as well as an ongoing earnings return (like dividends from shares or rent from a residential property).

All About Amur Capital Management Corporation

Rising cost of living is the continuous rise in the cost of living with time, and it can affect on our monetary well-being. One way to assist surpass inflation here are the findings - and generate favorable 'genuine' returns over the longer term - is by purchasing assets that are not simply capable of supplying higher income returns however likewise use the potential for capital development.